We have worked with many wealth management firms that have reached (or are approaching) an inflection point in their growth trajectories. These firms – commonly, though not exclusively founder-led firms between $200 million and $1.0 billion in AUM – recognize that a reliable growth strategy is critical to attracting and retaining talent and maintaining their competitive edge.

Further, there is a growing chorus contemplating the perennial strategic question: “Is what got me here going to be what can get me there?”

Historically, client referrals and market appreciation have dominated RIA growth strategies and, in many cases, have led to remarkable revenue expansion. For owners that have growth aspirations beyond referrals and/or are uncomfortable relying on the generosity of equity markets, there are a few paths to consider:

- Implement an organic growth plan that will work in today’s environment (“hold”)

- Acquire firms or recruit new advisors (“buy”)

- Merge into a larger organization with additional resources to fuel growth (“sell”)

This post addresses the benefits and risks of each, along with some helpful conditions that support success with each option. Of course, there is no “correct” path to take. Our goal is to simply provide objective information to help RIA leaders decide which option would work for their firm.

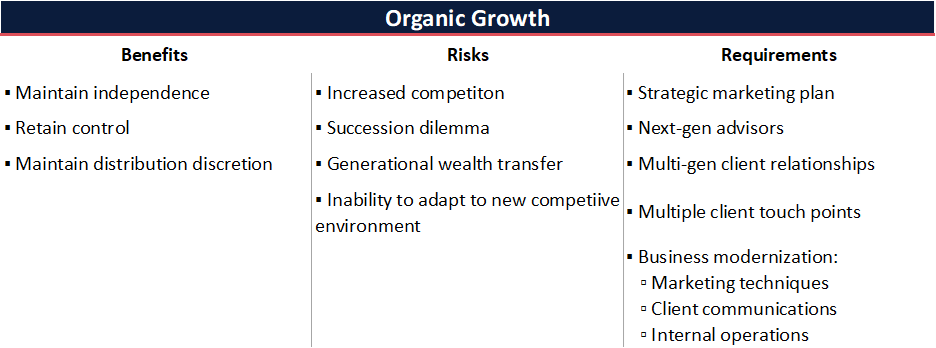

Organic Growth

Strategic decisions often result in an active, informed decision to “stay the course.” If wealth management firm leaders are satisfied in doing so, it is certainly a viable option to continue to rely on referrals or other tried and true marketing strategies to grow.

With that said, it is critical to account for the vastly different competitive environment going forward. We have entered a phase where fiduciary RIAs are increasingly competing for new business with fellow fiduciaries, many of whom are national players. This will require a re-thinking of positioning, messaging and tactics.

It will also be important to hone tactics and messaging to appeal to next-generation clients as we approach an unprecedented transfer of wealth. This includes attracting and training next-gen advisors that can adeptly navigate the impending generational wealth transfer.

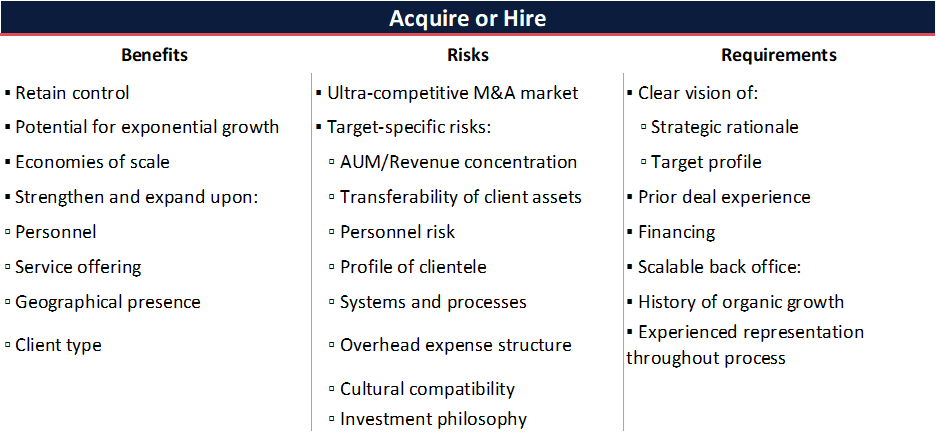

Acquire or Hire

Acquiring firms or individual books of business is an avenue worth exploring for advisory firms that seek to grow AUM, expand their geographical presence and/or bolster their current service offering. The primary benefits of this strategy are evident—the ability to retain control and the potential for higher growth rates.

Those new to the acquisition process will be well-served to think through what it takes to be a successful acquirer as well as the inherent risks of this path.

Foremost, the ultra-competitive nature of today’s M&A environment has resulted in valuations and deal terms that are highly favorable to sellers. What this means to a buyer is that the margin of safety is shrinking.

Successful inorganic growth strategies require a thorough understanding of value drivers and deal mechanics. Infrequent or inexperienced buyers run the risk of misfiring when structuring a strategic relationship. And with valuations at or near all-time highs, “getting it right” has never been more crucial.

To prepare for inorganic growth, would-be buyers must invest in their corporate infrastructure prior to embarking on an acquisition campaign. A scalable, updated back-office chassis is not only a prerequisite to support additional teams, but also a key starting point for a buyer’s value proposition. This includes investments in technology, compliance and operations – both in terms of people and processes.

When articulated during a deal process, these efforts will be evident and potential partners will place a high premium on a suitor’s “readiness.”

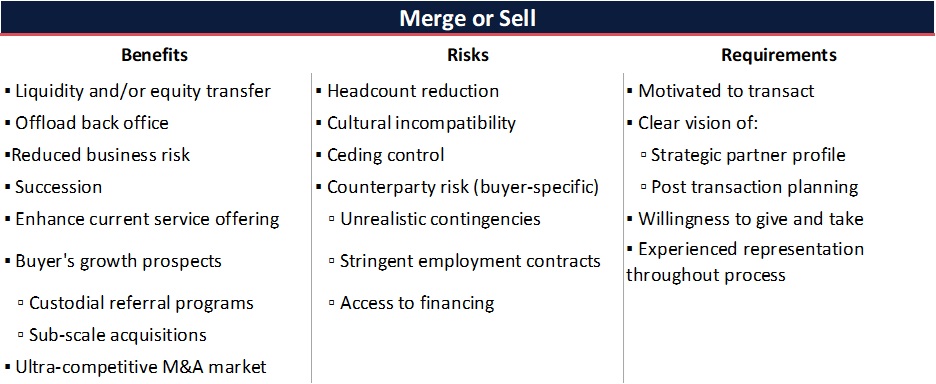

Merge With or Sell to a Larger Firm

Merging into a larger firm is not strictly a retirement strategy. It is also a growth strategy.

Swapping equity with a larger, well-resourced, acquisitive firm could be an incredibly lucrative path. All else being equal, larger firms have experienced higher organic growth rates. This can be attributed to larger marketing budgets, dedicated business development staff and wider access to centers of influence and custodial referral programs.

Larger firms also have the resources to fuel inorganic growth strategies. Many have adopted a well-oiled approach to supporting and financing tuck-ins, the benefits of which could accrue to the owners of an incoming firm.

Partnering with a larger firm can bolster your firm’s service offering. We find many sellers motivated to merge so that they can expand their service offering to include human capital-intensive services like sophisticated estate planning and tax preparation. By expanding and/or enhancing the services offered to existing clients, your firm can increase wallet share and strengthen the advisor/client tether.

Many owners that seek a strategic partner are motivated by a need to recast the roles played by their team. RIA leaders often see the highest and best use of their time as interfacing with existing or prospective clients, rather than running the business. Selling can solve for this pain point and unlock an incredible amount of value.

Of course, embarking on a merger or sale is not without its perils. The importance of cultural fit and a strong shared vision could not be understated. In our experience, the best way to defuse this risk is to approach the process with a well-articulated “wish list” and to drive a process that produces multiple potential partners from which to choose.

The best way to get “market price” for your firm is to create a market for your firm.

Even with a streamlined business model and simple ownership structure, there are inherent complexities in any M&A transaction. Having sophisticated counsel and advocacy will help to navigate and drive the process, while ensuring that you receive a fair market value and deal terms that meet your expectations and objectives.

Our industry has grown and evolved in many positive ways over the past twenty years. And while future industry growth prospects are equally optimistic, the strategies and tactics required to benefit from this growth have evolved as well. The good news is that there has never been a richer set of choices available to wealth management firms to support their growth aspirations.